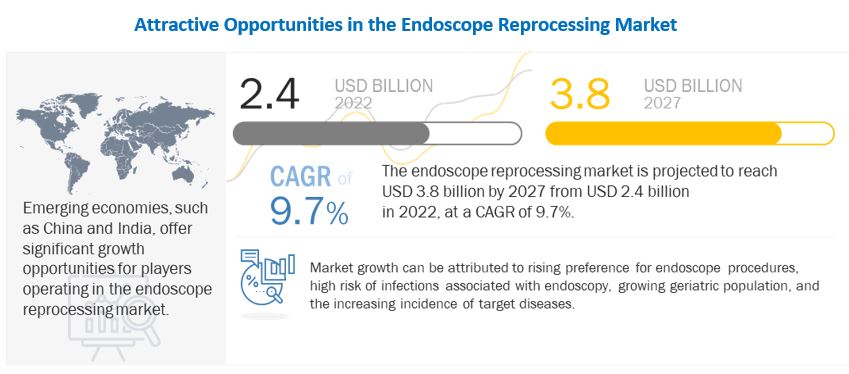

The Endoscope Reprocessing Market is projected to reach USD 3.8 billion by 2027 from USD 2.4 billion in 2022, at a CAGR of 9.7% from 2022 to 2027. The growth of this market is driven owing to increasing requirement for endoscopy to diagnose and treat target diseases, high risk of Endoscope-associated infections due to contaminated endoscopes, growing geriatric population and leading to increase in endoscopic procedures, and Increasing emphasis on improving reprocessing guidelines by healthcare authorities. Also, increasing investments, funds, and grants to improve healthcare infrastructure and research areas of endoscopy is anticipated to offer an opportunity for the growth of the market during the forecast period.

Download PDF Brochure:

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=219094994

Key Market Players:

Cantel Medical (US), Advanced Sterilization Products (ASP) (US), Olympus Corporation (Japan), Ecolab (US), STERIS (Ireland), Getinge AB (Sweden), Wassenburg Medical (Netherlands), CONMED Corporation (US), Belimed AG (Switzerland), Endo-Technik W. Griesat (Germany), Custom Ultrasonics (US), Steelco S.p.A. (Italy), BES Healthcare Ltd (UK), ARC Healthcare Solutions (Canada), Metrex Research, LLC. (Canada), Richard Wolf GmbH (Germany)

Market Dynamics

Driver: Increasing requirement for endoscopy to diagnose and treat target diseases

Endoscopy procedures are minimally invasive surgeries done through one or more small incisions, using small tubes, tiny cameras, and surgical instruments. Less pain, a shorter or no hospital stay, and less complications related to pre- and post-surgery care are the major advantages of endoscopy procedures. Hence, these procedures are more cost-efficient, more effective, and safer than traditional open surgeries. Also, these procedures are covered by health insurance providers in rich countries such as the US, Canada, the UK, Germany, Australia, and a few countries in the Middle East, such as the UAE. These factors lead to a high preference for endoscopy procedures among patients and physicians. Every year, nearly 11.0 million colonoscopies, 6.1 million upper endoscopies, 313,000 flexible sigmoidoscopies, 178,400 upper endoscopic ultrasound examinations, and 169,500 endoscopic retrograde cholangiopancreatography procedures are performed in the US (Source: Gastroenterology 2019).

Endoscopy is increasingly being used for the diagnosis/treatment of several major disorders, such as cancer, orthopedic disorders, neurological disorders, and gastroesophageal reflux disorder (GERD). According to GLOBOCAN 2021, 457 960 new cancer cases were diagnosed in the UK in 2020, and this number is anticipated to reach 27.5 million by 2040 (an increase of 61.7%). As a result, there will be significant growth in the number of cancer surgeries; for instance, around 80% of cancer cases are likely to require surgery (Source: Lancet Commission on Global Surgery). Thus, the rising incidence of target diseases, including cancer, neurodegenerative, infectious, immune, metabolic, and cardiovascular diseases, is expected to accelerate the need for endoscopy procedures, which, in turn, would propel the endoscopy equipment market growth in the coming years

Get Sample Pages:

https://www.marketsandmarkets.com/requestsampleNew.asp?id=219094994

Increasing preference for minimally invasive surgeries

Compared to open surgery, in a minimally invasive surgery (MIS), such as endoscopy, patients can experience lower rates of complications, shorter hospital stays, decreased blood loss, and lower readmittance rates at a reduced cost. Minimally invasive implants, robotic-assisted surgeries, and virtual care can empower healthcare transformation.

The use of different visual and standard instruments, such as laparoscopic and endoscopic instruments, and high-powered magnification devices, has allowed physicians to decrease the morbidity of many surgical procedures by eliminating the need for a large surgical incision. Minimally invasive surgeries have evolved through the development of surgical microscopes equipped with a camera to get visual images for maxillofacial surgeries alongside endodontic and periodontal surgical procedures.

The volume of endoscopic minimally invasive surgeries has witnessed steady growth over the past decade. These surgeries include bariatric surgery, surgery for gastroesophageal reflux disease (GERD), hernia surgery, and solid organ surgery. According to the American Society for Metabolic and Bariatric Surgery, the number of bariatric surgeries increased from 158,000 in 2011 to 256,000 in 2019. With this growth in the number of endoscopic surgeries performed, the demand for automated endoscope reprocessors, which facilitate high-level disinfection of endoscopes, is set to rise.

Restraints: High overhead costs of endoscopy procedures with limited reimbursement in developing countries

The cost per colonoscopy, including purchase, maintenance, and reprocessing, ranges from USD 188.64 at high-volume centers (3,000 annual procedures) to USD 501.16 at low-volume centers (1,000 annual procedures). Accordingly, per procedure cost ranges from USD 87.48 to USD 262.45; repair cost ranges from USD 68.77 to USD 206.32; cleaning supplies and labor cost from USD 32.39 to USD 50.11, and the cost of infections requiring hospitalization ranges from USD 20.12 to USD 46.52. As disposable colonoscopes have entered the market, low-volume centers are most likely to achieve cost savings. Healthcare providers particularly in developing countries such as India, Brazil, and Mexico have low financial resources to invest in such costly and sophisticated technologies. Moreover, the staff should be trained for the efficient handling and maintenance of endoscopy systems and equipment. Maintaining endoscopy equipment is of vital importance as improperly reprocessed endoscopes can lead to cross-contamination and potentially expose patients to infections. This can incur additional costs. Moreover, the constant heating and cooling during disinfection procedures can cause wear and tear on the insertion and light guide tubes, which can hamper the durability of endoscopy equipment. All these factors add to the cost of endoscopy procedures.

In 2021 Hospitals are expected to accounted the largest share of the endoscope reprocessing market, by end user.

Based on end users, the global endoscope reprocessing market is segmented into hospitals, ambulatory surgery centers and clinics, and other end users (diagnostic centers, mobile endoscopy facilities, and office endoscopy centers). In 2021, the hospitals' segment has the largest share due to large patient volume in hospitals related to endoscopic procedures leads to increase demand for endoscope reprocessing products in hospitals.

In 2021 North America accounted the largest share of the endoscope reprocessing market.

Based on region, the endoscope reprocessing market is segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2021, North America has the largest share of the endoscope reprocessing market. The largest share of North America can be attributed to factors such as the rising number of cancer cases, favorable reimbursement scenarios, and Increasing requirement for endoscopy to diagnose and treat target diseases.

Frequently Asked Questions (FAQ):

- Which region is anticipated to witness considerable growth in the endoscope reprocessing market?

- Which product is expected to hold the largest share in the endoscope reprocessing market?

- Which are the driving factors of the endoscope reprocessing market?

- What are the challenges witnessed in the endoscope reprocessing market?

- What is the impact of COVID-19 on endoscope reprocessing market?

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=219094994

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com